No, You're Not Crazy: Inflation Is Eating Us Alive

To wrap up my experiment in daily posting, I want to comment on a phenomenon I’ve been furious about for the past year: the cost of living crisis.

Unless you’re just fabulously wealthy and what my friend Jon Stokes calls “post-financial,” you’ve not only noticed, but felt, skyrocketed prices, alongside smaller packages and lower quality.

Unfortunately, there are a slew of “expert” who, for political reasons, want to convince you that this isn’t happening. I could point to dozens of examples, but the most recent one is from The Guardian: “Majority of Americans wrongly believe US is in recession – and most blame Biden.” Personally, I love the Axios spin on it: “There is no recession. And the economy is in good shape.”

I could pick this entire article apart, but let’s focus on inflation and cost of living:

The poll underscored people’s complicated emotions around inflation. The vast majority of respondents, 72%, indicated they think inflation is increasing. In reality, the rate of inflation has fallen sharply from its post-Covid peak of 9.1% and has been fluctuating between 3% and 4% a year.

In April, the inflation rate went down from 3.5% to 3.4% – far from inflation’s 40-year peak of 9.1% in June 2022 – triggering a stock market rally that pushed the Dow Jones index to a record high.

According to The Guardian, 72% of people are just wrong and need to be corrected, which is laughable. Let’s pick out a couple of things about inflation rate claims:

The rate of inflation just indicates how much inflation is going up. In other words, if the rate of inflation is 3.4%, that means it’s still going up, just at a slower pace than it once was.

When the average person cites “inflation,” what they really mean isn’t some arbitrary statistic, but the overall trend in prices. “Inflation” is relatively easy to measure, but also easy to manipulate. A sense of the cost of living is harder to measure, but also impossible to argue with.

Usually, when the government and other authorities talks about “inflation,” they use the Consumer Price Index, which tracks the prices of a somewhat arbitrary basket of goods, a method many economists criticize.

To add further confusion, there is also what is known as “Core CPI,” which excludes food and energy, which are both pretty darn important for living.

All of this is to say that these are very malleable figures, so it’s no wonder the average person doesn’t trust them, especially when numbers on a chart conflict with their own lived experience. And when you constantly hear a narrative that conflicts with that experience, you might feel crazy, a phenomenon called gaslighting.

How much have real prices gone up? Let’s look at some figures.

TheStreet examined how much fast food prices have gone up since 2020, measuring prices at McDonald’s, Taco Bell, Chick-fil-A, In-n-Out, Burger King, and Jack in the Box. They found that, on average, prices increased 77.4%. McDonald’s was the worst of the lot:

Cheeseburger: 215% price increase

McChicken: 201.6%

Medium French Fries: 134.1%

The Wall Street Journal recently looked at changes in household net worth in the Trump vs. Biden years. It’s equally eye-popping:

Real estate listing site Zillow recently conducted a study finding that the income needed to afford a home has increased by a whopping 80% since 2020 while median income has risen only 23%. In straight numbers, you need $47,000 more per year to afford a home than did you did four years ago.

On X, Michelle Barrett has been tracking her own grocery prices:

I picked a random Walmart order made on December 30, 2021. 14 items. Subtotal was $66.66.

Same items today? Some of the items are no longer available because the unit quantity has changed.

Cake mix was $1.24 for 15.25 oz. Now, the box is $1.58 for 13.25 oz.

The 12-pack of paper towels was $15.94 with a total area of 649 sf. Now, it's only $15.84, but for 594.9 sf.

Adding those to the cart anyway and I get a subtotal of $81.42.

That's an increase of about 22% in only 29 months.

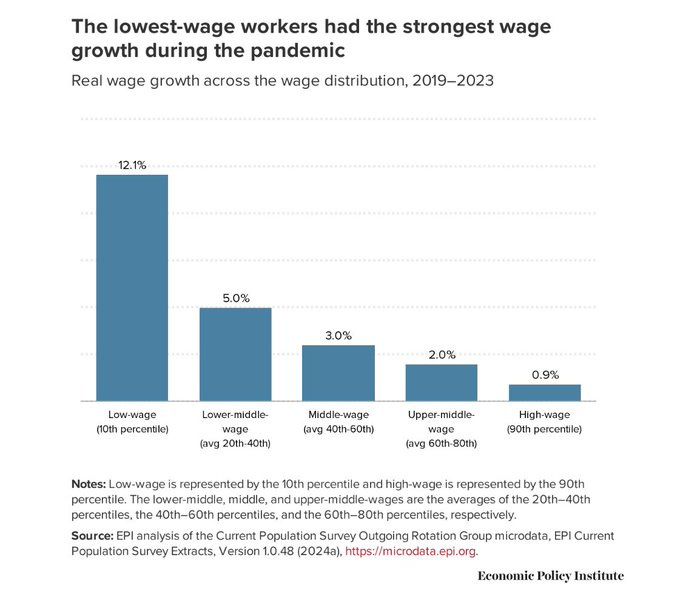

Across the board, we’ve seen price increases ranging from 20-200%—much more than the 3.5% official figure. One counterargument is that wages are rising to keep up, but even the most optimistic estimate on wage growth is about 12.1% per the Economic Policy Institute.

So, no, you’re not crazy: everything is dramatically more expensive and your wages aren’t keeping up.

Another counterargument I’ve heard is that this isn’t inflation, it’s simply companies gouging their customers. Here’s what I say to that:

We’re seeing prices increase on everything from food to software to housing. Is there a worldwide collusion conspiracy to bilk consumers?

If so, why isn’t the federal government investigating?

I don’t know how we fix this problem, but I can say this much: it begins with acknowledging reality. The American people know they’re being lied to, they’re angry about it, and they’re ready to reelect Donald Trump in November. To the so-called “experts” desperately trying to stop that: You can lie to the people about many things and get away with it, but you can’t argue with their budgets and bank accounts.