The Doom Economy

A possible explanation of post-COVID economic weirdness.

In the past, when you hit middle age, there was a tradeoff. Your physical state might start its inevitable decline, but that was countered by your accumulated wisdom about how the world operates.

As a millennial who just turned 40, I don’t feel as though I have any of that promised wisdom at all, because COVID seems to have permanently flipped the rules of adult life upside down.

For example, one thing you could always count upon was a new car dropping drastically in value the second it left the lot. If you were willing to buy a model that was just a couple of years old, you could snag it at a steep discount.

That is largely no longer true. In fact, many people are finding that they can buy a car new and flip it in a few months for more than what they paid for it.

Inflation is now debatably under control, but the price of everything is sky-high alongside interest rates. This leaves my family in an interesting position of not really being able to afford where we live anymore while also not being able to afford to move. And that’s despite making more money than I ever have in my life.

Yet, despite this, it seems like everyone is living it up with lavish vacations, new cars, and other luxuries1. What gives?

I’ve spent the past few years trying to make sense of this. At first, it was obvious: the government was sending out stimmy checks while locking people into their houses. So everyone was spending and few were working.

But then the stimulus money stopped and… nothing seemed to change? Economists have been scratching their heads trying to figure out what’s going on, and I think I may have an answer. I call what we’re experiencing the Doom Economy.

The Doom Economy Hypothesis

In the wake of a series of traumatic and world-shattering events such as the COVID-19 pandemic, large-scale riots, political unrest, and the war in Ukraine, consumers have decided that short-term comforts take precedence over longer-term economic responsibility.

A key trigger of the doom economy is the cost of living crisis. When the basic staples of life are as unaffordable as luxuries and consumers have to pile on credit card debt just to live, then why does any of it matter? If you have to take out a loan for groceries, why not pick up a new BMW while you’re at it?

In effect, the economy has become a joke to the average person. If living is unaffordable, the social contract is effectively broken. Why go to work if you can’t make enough to live? Why pay bills? If you have to take out a loan to buy groceries, why not buy a nice car and simply not pay the bill? What does it matter?

Prices keep rising along with demand because consumers simply aren’t price sensitive anymore. They take out mortgages and auto loans, and rack up credit card debt without any concern for paying it back. Because with the way things are going, maybe they won’t have to ever pay it back? Best to live for today. Let us eat and drink, for tomorrow we die.

This was exacerbated by the halo effects of COVID: lockdowns, job losses, being told that their jobs were “nonessential,” and the general crisis of despair, which began well before COVID.

This is very much a hypothesis and not a theory because I don’t have reams of hard data. However, we have a number of data points and anecdotes that suggest this is what’s happening:

Americans turning to credit cards as 90 million Americans can’t pay their bills.

Canadian credit card debt climbing as they struggle to pay bills.

TikTok videos of people buying cars and bragging that they’ll never pay the note.

To that last point, many auto lenders are tightening up or closing up shop.

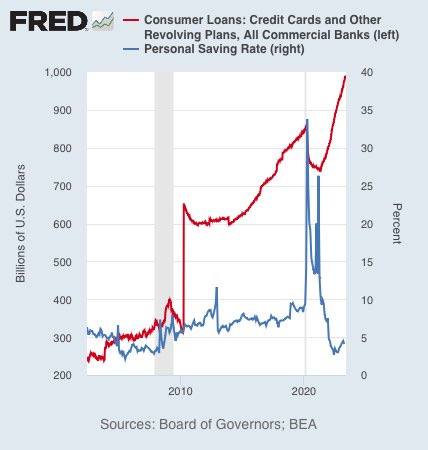

FRED chart of debt vs. savings:

Where Does the Doom Economy Lead?

Let’s say my hypothesis is correct. Westerners are racking up debt they will never pay back—whether for essentials or other goods and services.

Sooner or later, that bill will come due, much like it did in 2008.

The most “reasonable” scenario is that the federal government once again rushes to the rescue of the banks, at least the big ones. Smaller lenders go under, credit markets tighten, and—after tremendous pain—things eventually go back to something resembling normal.

But the $10 trillion question is: how much slack is in the system? The post-2008 economy was largely held together by historically low interest rates, and that worked well until COVID fired up the money-printing machine and inflation shot through the roof.

As we’ve pointed out many times here at Unprepared: the Fed is between a rock and a hard place. Raising interest rates seems to have slowed inflation, but the cost of living is still too high for many Americans. And W-2 wagies are going to have a tough time climbing out of that because as economic conditions tighten, raises are going to be out of the question as CEOs prepare for recession.

We’re seeing some other unexpected third-order effects. Much of the current crop of online services was built on the back of the free money machine. Now that those days are over, things are getting ugly fast: see Reddit CEO Steve Huffman’s desperate battle against his own users for a taste of things to come there.

There’s also the possibility that things really hit the fan and the Fed decides it’s the perfect opportunity to launch a Central Bank Digital Currency.

For now, I recommend the following:

Pay your bills, if you can.

Don’t buy silly shit, no matter how over it you are.

Don’t quit your day job.

If you’ve ever wanted to start a business, now is the time.

A quick anecdote: I just took my daughter out for her birthday, and a Love’s truck stop gas station in the middle of nowhere Kentucky was slammed with summer travelers like I’ve never seen before. We tried to get gas for 15 minutes before giving up. We stopped at the same station later in the day, and it was nearly as busy as it had been there morning. Thankfully, we could get gas the second go-round. Inside, there was a line outside the ladies’ bathroom. I’ve never seen anything like it.